The discipline of the Global Minimum Tax, Scope of Application and Starting Data

In the second newsletter related to GMT, the scope of the discipline and its effective date are examined.

Scope of Application

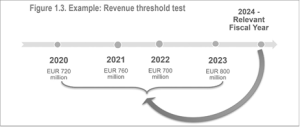

Pursuant to Article 10 of Legislative Decree 209/2023, the GMT rules apply to companies located in Italy that are part of multinational or domestic groups with annual revenues of at least 750 million euros in at least 2 of the 4 fiscal years immediately preceding the one under consideration. The limit is calculated on the basis of data taken from the consolidated financial statements. The use of the aforementioned time base, as specified by the same explanatory report to Decree 209/2023, is functional to balance the effects of fluctuations in revenues from one year to the next and, moreover, ensures that the company already knows, at the beginning of the fiscal year, whether or not it may be subject to the levy. Figure 1.3, illustrated in the “implementation handbook,” is reproduced below for illustrative purposes.

As can be observed, with reference to the year 2024, the 750 million revenue limit on a consolidated basis, looking at data from 2020 to 2023, was exceeded in both fiscal year 2021 and 2023; therefore, the group would fall within the scope of the GMT for 2024.

The second paragraph of Article 10 under comment then regulates the case when the tax period of the multinational or domestic group is other than 12 months. Specifically, it is stipulated that when one or more of the four fiscal years included in the test are greater than or less than 12 months, the 750 million euro limit must be adjusted proportionally for each of those fiscal years.

The third paragraph of Article 10 then provided specific provisions for newly established companies: in fact, if they do not have consolidated financial statements for previous fiscal years, it is required to apply GMT rules starting from the third fiscal year, if it reaches the minimum revenue limit in the previous 2.

Lastly, Article 11 provided cases of exclusion from the application of GMT for a number of entities, including but not limited to state entities, international organizations, nonprofit organizations, pension funds, and investment funds.

Starting data

The provisions in question, pursuant to Article 60 of Legislative Decree No. 209/2023, apply to fiscal years beginning on or after December 31, 2023 (2024 for entities with fiscal years coinciding with the calendar year).

However, the provisions on the supplementary minimum tax set forth in Articles 19, 20 and 21 of LD 209/2023, relating, respectively, to the application of the supplementary minimum tax, the application of the supplementary minimum tax in the country of the parent parent company, and the calculation and imputation of the supplementary minimum tax, are postponed to fiscal years beginning on or after December 31, 2024. If, however, pursuant to Article 57(1) of Legislative Decree No. 209/2023, the parent entity of a multinational group of enterprises is located into a member state that has opted to defer the application of both the supplementary minimum tax the enterprises of such multinational group located in Italy are subject to the Italian supplementary minimum tax for fiscal years beginning on or after December 31, 2023.

STAY UP TO DATE WITH THE LATEST TAX NEWS. CLICK HERE TO FIND OUT MORE!